I hope you got along with your college roommates. You may have to live with them for quite a while after graduating. You already know that you can’t afford a house. Now you can forget about even renting your own place as well, even after you land your first professional gig. Making a lot of money seems impossible at times, but one way to start making your money grow is by investing. Maybe it’s time to find out how to start investing.

I hope you got along with your college roommates. You may have to live with them for quite a while after graduating. You already know that you can’t afford a house. Now you can forget about even renting your own place as well, even after you land your first professional gig. Making a lot of money seems impossible at times, but one way to start making your money grow is by investing. Maybe it’s time to find out how to start investing.

RBC came out with a new Housing Trends and Affordability report last week that showed how the price of buying a home was dangerously unaffordable in the country’s hottest markets. For people just launching their careers, earning an entry-level wage, buying a house in the city probably wasn’t part of the short-term plan anyway.

However, using the same affordability formula, there are cities in Canada where even renting a one-bedroom apartment is too expensive for the average starting salary. It might be worth looking away from the bigger cities and towards something like a for rent apartment wellington aurora.

The basic rule of thumb is that you should spend roughly 30 per cent of your gross monthly income on rent. Therefore, if you earn the average Canadian wage of $50,000, you’d be getting about $4,150 per month before taxes. With that salary, your rent should be $4,150 x 0.3, or $1,245 a month.

By that model, a single person making the average wage can’t afford to live in Vancouver where the going rate of a one-bedroom apartment is $1,700 a month or in Toronto where it will set you back $1,330.

But how about those young professionals just starting out their careers and trying to establish themselves on an entry-level salary? It gets worse.

The average starting salary for full-time jobs in Canada is just shy of $40,000. (It generally takes university and college graduates at least two years of work experience to crack the $45,000 salary mark.)

Assuming you were making that $40k, your rent should be about $1,000 a month. Now that is 30 per cent of your before tax income, but it is nearly half of your take-home pay. That leaves basically another $1,000 for food, transit, phone/internet/utilities, loans, entertainment, clothing, and dare I say savings. It’s tight.

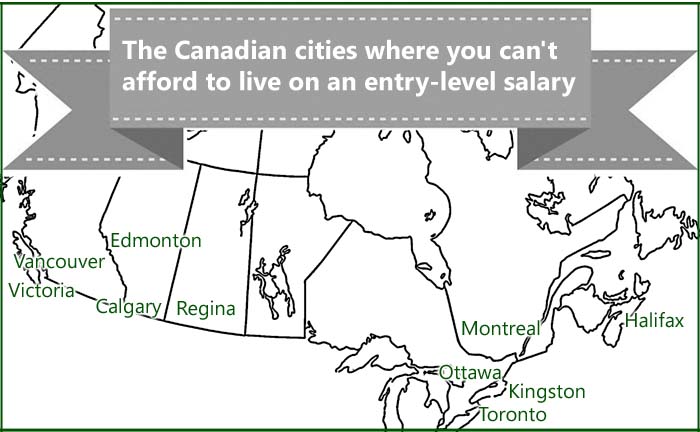

But even if you can swing it, you won’t be renting your own place in five major Canadian cities, and you’ll be scraping by in five others. However, a few have managed to but their own homes, it must be nice to get a mortgage pre approval, we aren’t saying that getting that point is impossible, it’s just a challenge in today’s world.

Five Canadian cities where young professionals can’t afford to start their careers

| City | Average rent for a one-bedroom apt. | |

| Vancouver | $1,700 | |

| Toronto | $1,330 | |

| Calgary | $1,080 | |

| Victoria | $1,070 | |

| Ottawa | $1,040 |

Five Canadian cities where the average entry-level salary allows you to just barely scrape together enough for a one-bedroom apartment.

| Rent | Average rent for a one-bedroom apt. | |

| Montreal | $1,000 | |

| Edmonton | $980 | |

| Regina | $970 | |

| Kingston | $960 | |

| Halifax | $940 |

So what are most of us actually earning right now? Here’s a look at the average Canadian salary by region and industry.

Rental cost by city data from PadBlogger, August 2016.

Canadian salary data from Statistics Canada.